You're right - I'm not a tax expert, but it seems to me subsidizing the wealthy makes the world go round. Why is everyone so pissed off if the wealthy get tax breaks? They still pay a whole chunk more that we poor folk do. I have no problems here except I wish we'd do away with the IRS completely. Can we do that please?Do you guys even tax code?

1. 401k gains arent subject to capital gains. They are taxed as ordinary income.

2. It has nothing to do with class welfare. It’s a question of fairness. Why should capital gains be taxed at 20% but earned income be taxed at up to 36%. You guys are just subsidizing the wealthy. I’m always amazed at how easily people are duped into this.

3. The middle class don’t have “estates”, which are exempt from capital gains anyway.

4. 75% of the benefit goes to the top 1%.

https://www.taxpolicycenter.org/briefing-book/what-effect-lower-tax-rate-capital-gains

Critics are correct that low tax rates on capital gains and dividends accrue disproportionately to the wealthy. The Urban-Brookings TaxPolicy Center estimates that in 2019, more than 75 percent of the tax benefit of the lower rates went to taxpayers with income over $1 million (table 1).

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Please don't make me grovel

- Thread starter kjfreeze

- Start date

That’s kind of my point. You paid a lower tax rate that helped enable you to buy those things.

Prior to 1997, it wasn't lower.

I was able to buy the things that you listed because I became my own boss and increased my income by more than 10 fold.

Further, I will not take the hit if you tax me more. I will reduce expenditures through my businesses to make sure that I make my nut. What's the fastest way to reduce expenditures as a business owner in your opinion? I'm also much less likely to grow my operations or create new ventures, which would absolutely stunt my ability to employ more people.

I think you think that you have a handle on theory. BSC, I'm not relying on theory.

First you don't subsidize anyone by allowing them to keep their moneyYou're right - I'm not a tax expert, but it seems to me subsidizing the wealthy makes the world go round. Why is everyone so pissed off if the wealthy get tax breaks? They still pay a whole chunk more that we poor folk do. I have no problems here except I wish we'd do away with the IRS completely. Can we do that please?

Second , we should repeal the 16th amendment and institute the fair tax.

IRS would only be concerned that businesses are collecting and remitting the sales taxes. Average Joe would never need be concerned with them ever again other than providing address for the prebate and the number of people who are in the household.

Because the Top 1% are paying AT LEAST 75% of the taxes.Do you guys even tax code?

1. 401k gains arent subject to capital gains. They are taxed as ordinary income.

2. It has nothing to do with class welfare. It’s a question of fairness. Why should capital gains be taxed at 20% but earned income be taxed at up to 36%. You guys are just subsidizing the wealthy. I’m always amazed at how easily people are duped into this.

3. The middle class don’t have “estates”, which are exempt from capital gains anyway.

4. 75% of the benefit goes to the top 1%.

https://www.taxpolicycenter.org/briefing-book/what-effect-lower-tax-rate-capital-gains

Critics are correct that low tax rates on capital gains and dividends accrue disproportionately to the wealthy. The Urban-Brookings TaxPolicy Center estimates that in 2019, more than 75 percent of the tax benefit of the lower rates went to taxpayers with income over $1 million (table 1).

Tax revenue is hardly affected by the rates. GDP has shown to benefit from tax cuts and revenue has increased due to the rise in GDP. GDP is a larger factor in tax revenue. This country has never had a revenue problem in my lifetime. The problem has been that spending has outpaced the increase in revenue. Before zer0 the gubmint averaged 18% of GDP regardless of the marginal tax rates.

So why would the rate matter if its a non-factor. Well one poster hit on it . The highly subjective idea of "fairness."

zer0 even admitted that he didnt care about the rates not raising revenue but in fairness.

Thatcher even exposed it one of her Prime Ministers Questions:

So why would the rate matter if its a non-factor. Well one poster hit on it . The highly subjective idea of "fairness."

zer0 even admitted that he didnt care about the rates not raising revenue but in fairness.

Thatcher even exposed it one of her Prime Ministers Questions:

Ignorance Related Slavery

Feel free to give me the Federal Registry Number (available in most large public libraries) for the Law that requires me, as a citizen of the Republic of Florida, to play a Federal Income Tax on my earned wages.

And don't quote me any IRS Codes, because those codes require an enabling LAW in order for them to apply to a sovereign citizen of the Republic of Florida.

BTW, wages are not income under the law, so know the difference.

The last time there was such a law was during WWII (The Victory War Tax) and it was abolished in 1947 at the end of WWII. The IRS decided to continue sending out the forms, trusting that the ignorant fools would continue to give up their money.

The IRS doesn't go after anyone under Tax law, they go after you under 'Contract Law' because you signed a W-2 agreeing to pay them.

And this is why when they lose a case, in order for you to get them off your back and out of your life, one of their conditions is to have the case SEALED so others don't find out....

I'd like to drive a stake through those vampires hearts, but I'll more likely have a stake driven through mine now. But like those coming forward with their military UFO testimony, I'm old and ready to die now, so they can have at me....

But like those coming forward with their military UFO testimony, I'm old and ready to die now, so they can have at me....  (crazy or fool-hardy for posting this)

(crazy or fool-hardy for posting this)

Get rid of the IRS and I'll gladly pay a Federal Sales Tax to replace it/them.

I've always thought that the IRS should be prosecuted under the RICO Act.

"The Racketeer Influenced and Corrupt Organizations (RICO) Act is a United States federal law that provides for extended criminal penalties and a civil cause of action for acts performed as part of an ongoing criminal organization."

All anyone has to do to prove me incorrect is to answer me on how this began:

Feel free to give me the Federal Registry Number (available in most large public libraries) for the Law that requires me, as a citizen of the Republic of Florida, to play a Federal Income Tax on my earned wages.

Feel free to give me the Federal Registry Number (available in most large public libraries) for the Law that requires me, as a citizen of the Republic of Florida, to play a Federal Income Tax on my earned wages.

And don't quote me any IRS Codes, because those codes require an enabling LAW in order for them to apply to a sovereign citizen of the Republic of Florida.

BTW, wages are not income under the law, so know the difference.

The last time there was such a law was during WWII (The Victory War Tax) and it was abolished in 1947 at the end of WWII. The IRS decided to continue sending out the forms, trusting that the ignorant fools would continue to give up their money.

The IRS doesn't go after anyone under Tax law, they go after you under 'Contract Law' because you signed a W-2 agreeing to pay them.

And this is why when they lose a case, in order for you to get them off your back and out of your life, one of their conditions is to have the case SEALED so others don't find out....

I'd like to drive a stake through those vampires hearts, but I'll more likely have a stake driven through mine now.

Get rid of the IRS and I'll gladly pay a Federal Sales Tax to replace it/them.

I've always thought that the IRS should be prosecuted under the RICO Act.

"The Racketeer Influenced and Corrupt Organizations (RICO) Act is a United States federal law that provides for extended criminal penalties and a civil cause of action for acts performed as part of an ongoing criminal organization."

All anyone has to do to prove me incorrect is to answer me on how this began:

Feel free to give me the Federal Registry Number (available in most large public libraries) for the Law that requires me, as a citizen of the Republic of Florida, to play a Federal Income Tax on my earned wages.

A lie.What do you call people making over $1M per year with 2 trucks and an AMG?

A lie.

I think he was referring to me but I've never mentioned my income so I'm not sure what that was about.

Because the Top 1% are paying AT LEAST 75% of the taxes.

IIRC that number is in the high 90's. Could be wrong though.

YES !!! NO MORE IRS !!!First you don't subsidize anyone by allowing them to keep their money

Second , we should repeal the 16th amendment and institute the fair tax.

IRS would only be concerned that businesses are collecting and remitting the sales taxes. Average Joe would never need be concerned with them ever again other than providing address for the prebate and the number of people who are in the household.

A lie.

Don’t call @BamaFan1137 a liar. I believe him. One of the few millionaire sheriff deputies.

And I believe you’re a doctor.

Im the trusting sort.

If you have three vehicles, including an AMG and a 350 then you’re either a millionaire or a drug dealer.I think he was referring to me but I've never mentioned my income so I'm not sure what that was about.

Wrong. Top 10% though.IIRC that number is in the high 90's. Could be wrong though.

Wow. Just wow.You're right - I'm not a tax expert, but it seems to me subsidizing the wealthy makes the world go round. Why is everyone so pissed off if the wealthy get tax breaks? They still pay a whole chunk more that we poor folk do. I have no problems here except I wish we'd do away with the IRS completely. Can we do that please?

You realize someone has to pay taxes, don’t you? If not the wealthy, who do you think picks up the slack? You are Trump’s dream child.

All good questions. I’m well versed in the theory as well as the real world.Prior to 1997, it wasn't lower.

I was able to buy the things that you listed because I became my own boss and increased my income by more than 10 fold.

Further, I will not take the hit if you tax me more. I will reduce expenditures through my businesses to make sure that I make my nut. What's the fastest way to reduce expenditures as a business owner in your opinion? I'm also much less likely to grow my operations or create new ventures, which would absolutely stunt my ability to employ more people.

I think you think that you have a handle on theory. BSC, I'm not relying on theory.

1. Studies show that raising the cap gains rate, and taxes on the top 1% would result in little economic change. I can quote several studies if you are interested. The top 1% have plenty of discretionary income to absorb the impact.

2. If I increase your taxes, assuming you aren’t at break even, then you shouldn’t reduce expenditures at all. If you are wasting money on unnecessary expenditures, the tax rate shouldn’t matter. Unless you are talking about more money for golf, parties, and useless entertainment.

3. Keep in mind we’re talking about the capital gains rate, not the corporate tax rate. I was in favor of Trump’s reduction in the corporate tax rate since we were uncompetitive with other countries. The cap gains rate is only after you have SOLD your business.

Good discussion.

So they have 99% of the income/wealth but only pay 75% of the taxes? Must be that FSU math.Because the Top 1% are paying AT LEAST 75% of the taxes.

A lie.

I assume you are talking to bsc.

You know what they say about people that assume........I assume you are talking to bsc.

Wow. Just wow.

You realize someone has to pay taxes, don’t you? If not the wealthy, who do you think picks up the slack? You are Trump’s dream child.

I guess the ignorant moe-rons like you missed out on the Grace Commission report,,, among the many other things that you've missed out on in your life...

The Grace Commission Report was presented to Congress in January 1984. The report was in depth and showed that if its recommendations were followed, $424 billion could be saved in three years, rising to $1.9 trillion per year by the year 2000.

The Grace Commission Report - Revealed IRS Front for Banking Dynasties in 1984 Details of the private collection agency and money laundering operation call the Internal Revenue Service.

The final report of the 1984 Grace Commission, convened under President Ronald Reagan, quietly admitted that none of the funds they collect from federal income taxes goes to pay for any federal government services. The Grace Commission found that those funds were being used to pay for interest on the federal debt, and.....

To continue learning about reality, use the link.

https://www.frank-webb.com/the-irs-is-a-fraud---grace-commission.html

LOL. That’s crazier than your belief in aliens.I guess the ignorant moe-rons like you missed out on the Grace Commission report,,, among the many other things that you've missed out on in your life...

The Grace Commission Report was presented to Congress in January 1984. The report was in depth and showed that if its recommendations were followed, $424 billion could be saved in three years, rising to $1.9 trillion per year by the year 2000.

The Grace Commission Report - Revealed IRS Front for Banking Dynasties in 1984 Details of the private collection agency and money laundering operation call the Internal Revenue Service.

The final report of the 1984 Grace Commission, convened under President Ronald Reagan, quietly admitted that none of the funds they collect from federal income taxes goes to pay for any federal government services. The Grace Commission found that those funds were being used to pay for interest on the federal debt, and.....

To continue learning about reality, use the link.

https://www.frank-webb.com/the-irs-is-a-fraud---grace-commission.html

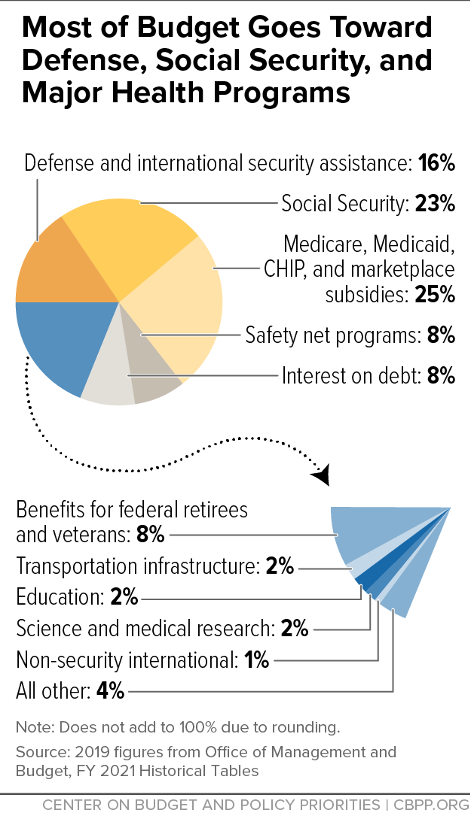

https://www.cbpp.org/research/federal-budget/policy-basics-where-do-our-federal-tax-dollars-go

LOL. That’s crazier than your belief in aliens.

https://www.cbpp.org/research/federal-budget/policy-basics-where-do-our-federal-tax-dollars-go

While you're happy to remain blissfully IGNORANT on both subjects...

BTW, the Budget and the money collected by the IRS are two entirety different things.

Moe-Ron confirmed yet again...

It wasn’t true 35 years ago and it’s not true now.While you're happy to remain blissfully IGNORANT on both subjects...

Wasn’t Reagan president then? Maybe he should have said something about this.

It wasn’t true 35 years ago and it’s not true now.

Show us your research proving that the Grace Commission report is fraudulent.

No. It shows you don’t understand what it said. I won’t waste my time with this nonsense. Maybe Reagan should have done something about it.Show us your research proving that the Grace Commission report is fraudulent.

No. It shows you don’t understand what it said. I won’t waste my time with this nonsense. Maybe Reagan should have done something about it.

- They shot him, so he then changed his mind about going after them, having seen what happened to the Kennedy brothers, George Wallace, and MLK.

William R. Kennedy Jr. and Robert W. Lee have summarized the Grace Commission Report in an easy-to-read 160-page paperback. (It took those 2 guys a 160 page book, just to summarize what was in the report. Here are some highlights -- iG)

(But I'm sure that ole BS-C911 has studied it all in depth and is ready to tell us all about it) --- (correction, he's bailed out on condition of his vast ignorance)

On February 18, 1982, President Reagan announced the formation of the Private Sector Survey on Cost Control, to be chaired by entrepreneur J. Peter Grace. The commission was to attempt to scrutinize government spending through the eyes of private-sector business ... in effect, to study the government as if it were a firm with which commission members were considering merger. The Grace Commission (as it came to be known) worked on its study for about 18 months and turned in a comprehensive report consisting of 47 volumes that document nearly 2,500 specific recommendations. Precious few of us "little guys" are likely to be willing or able to wade through 36 major reports and 11 special subject studies.

Foreign Loan Subsidies (America First)

Potential Savings: $360 million

The Grace Commission discovered that taxpayers are subsidizing foreign borrowers. Interest rates in 1970 on Official Development Assistance (O.D.A.) loans, for instance, were 69 percent of the Treasury bond rate (the price at which the federal government borrows money). But by 1981, that foreign rate had plummeted even further, to a mere 27 percent of the T-bond rate. Which means, in the Grace Commission's words, that "foreign borrowers were getting loans from American taxpayers at 2.5 percent." If the foreign rate could once again be raised to at least the 1970 average of 69 percent, taxpayers would realize a savings of $360 million — an amount equal to the federal income taxes paid by 162,308 median-income families in 1983.

Parole Review (pissing our money away)

Potential Savings: $256,200 per year

A prisoner who appeals an unfavorable parole decision is presently entitled to a two-step review of the decision. Incredibly, the same official who initially ruled on the appeal is also assigned to conduct the second review. In the eyes of the Grace Commission, this would make the first examination entirely redundant. Scrapping it would save an estimated $256,200 annually. (If the two-step review is not abandoned, it should certainly be conducted by two different officials!

Abuse of Legal Services

Potential Savings: in the millions

The Criminal Justice Act authorizes free legal representation for defendants unable to pay the costs themselves. For 1981, the bill was $28 million. A judge's decision regarding a defendant's eligibility is based primarily on the (usually unverified) financial information which the latter supplies the court. One "unemployed" recipient of free legal counsel cited by the Grace Commission "turned out to own $4,000 ... in traveler's checks, two race horses, a pair of Mercedes and a motor home." It is difficult to know the full extent of this sort of taxpayer-funded rip-off, but it undoubtedly runs into the millions of dollars.

Disaster Relief

Potential Savings: in the billions

Congress usually funds federal disaster relief programs in advance, with annual lumpsum appropriations going to agency disaster accounts. Such advanced funding does not earmark money for a specific disaster, so agencies may allocate the funds at their own discretion. In 1980, Congress reacted to the Mount St. Helens disaster in Washington state with a $946 million relief appropriation. But, as summarized by the Grace Commission: "Due to the phrasing of the regulation ... the money could be used in other areas. In fact, only $386 million of the $946 million (41 percent) was spent on the Mount St. Helens disaster. The balance of $560 million was spent on other disasters and could not be traced because it 'lost its identity.'" [Emphasis added.]

(where was Joe Biden in 1980? Not leaving a trace is my best guess)

Rate Inconsistency (you want a socialist green new deal?)

The inconsistency of rate schedules among various federal agencies often leads one agency to pay far more for an identical service or commodity than another. The Commission cites an example where the "Environmental Protection Agency paid substantially more than the U.S. Coast Guard for the same services provided by the same contractor." The inflated charge, the Commission concluded, "was due largely to the different billing standards used by EPA and the Coast Guard. For example, the Coast Guard will pay $100 per week for the use of an office trailer. The EPA's schedule allows for $100 per day."

And those few examples are just the tip of a very ugly taxplayer ripoff iceberg.

The bad part is that's the budget, not what your tax dollars are going for.

The IRS Collected money goes to foreign bankers that loan us our own money, and then tax us solely to play the interest on those loans.

Don’t call @BamaFan1137 a liar. I believe him. One of the few millionaire sheriff deputies.

And I believe you’re a doctor.

Im the trusting sort.

Keep it up sparky and then cry when I go low. Typical lib.

Here's your chance to link where I told you how much I make or my net worth.

If you have three vehicles, including an AMG and a 350 then you’re either a millionaire or a drug dealer.

Haha, we have more than 3 vehicles. Why do you care?

Just the endorsement I've been looking for, Sir.Don’t call @BamaFan1137 a liar. I believe him. One of the few millionaire sheriff deputies.

And I believe you’re a doctor.

Im the trusting sort.

All good questions. I’m well versed in the theory as well as the real world.

1. Studies show that raising the cap gains rate, and taxes on the top 1% would result in little economic change. I can quote several studies if you are interested. The top 1% have plenty of discretionary income to absorb the impact.

2. If I increase your taxes, assuming you aren’t at break even, then you shouldn’t reduce expenditures at all. If you are wasting money on unnecessary expenditures, the tax rate shouldn’t matter. Unless you are talking about more money for golf, parties, and useless entertainment.

3. Keep in mind we’re talking about the capital gains rate, not the corporate tax rate. I was in favor of Trump’s reduction in the corporate tax rate since we were uncompetitive with other countries. The cap gains rate is only after you have SOLD your business.

Good discussion.

If I'm a millionaire, billionaire or trillionair, I'll still have a budget. Your ideas on how I assume more of a tax burden are naive.

All of my controllable expenses would take a hit in such a circumstance. Number of employees, pay rate, bonuses, capital improvements, expansion, equipment upgrades or replacement.

Just because company X has a lot of revenue, it doesn't mean there's a lot left lying around to pay more in tax. That's utterly juvenile. But it is the Democrats way of thinking.

Haha, we have more than 3 vehicles. Why do you care?

Because he's the kind that judges by the content of your wallet, instead of the content of your character,,, and that's why he's a Progressive Socialist monger....

So they have 99% of the income/wealth but only pay 75% of the taxes? Must be that FSU math.

The 1% doesn't have 99% of the income/wealth. 1% means they are in the top 1% of wealth. It means that they are wealthier than 99% of the people.

If there were 100 people on earth and the 1 percenter had $2 while the other 99 had $1, the 1 percenter doesn't have 99% of the wealth.

You’re theory would work until you see how much more Jeff Bezos, Warren Buffet, Bill Gates and Mark Z make compared to the other 99%. Hint. It’s not just twice as much.The 1% doesn't have 99% of the income/wealth. 1% means they are in the top 1% of wealth. It means that they are wealthier than 99% of the people.

If there were 100 people on earth and the 1 percenter had $2 while the other 99 had $1, the 1 percenter doesn't have 99% of the wealth.

Last edited:

I don’t. You’ve earned it.Haha, we have more than 3 vehicles. Why do you care?

Keep it up sparky and then cry when I go low. Typical lib.

Here's your chance to link where I told you how much I make or my net worth.

You haven’t. It wasn’t a dig. I really do believe you. Just a little friendly banter.

I never said you would want to. It just may mean you would have one less vehicle while contributing more to the national debt.If I'm a millionaire, billionaire or trillionair, I'll still have a budget. Your ideas on how I assume more of a tax burden are naive.

All of my controllable expenses would take a hit in such a circumstance. Number of employees, pay rate, bonuses, capital improvements, expansion, equipment upgrades or replacement.

Just because company X has a lot of revenue, it doesn't mean there's a lot left lying around to pay more in tax. That's utterly juvenile. But it is the Democrats way of thinking.

?? Illegal aliens? lolWow. Just wow.

You realize someone has to pay taxes, don’t you? If not the wealthy, who do you think picks up the slack? You are Trump’s dream child.

You’re theory would work until you see how much more Jeff Bezos, Warren Buffet, Bill Gates and Mark Z make compared to the other 99%. Hint. It’s not just twice as much.

Either way, 1 percenter does NOT refer to them having 99% of wealth.

It depends. It can refer to either. But they are mainly the same, unless you just inherited your wealth.Either way, 1 percenter does NOT refer to them having 99% of wealth.

Similar threads

- Replies

- 62

- Views

- 1K

- Replies

- 2

- Views

- 126

- Replies

- 132

- Views

- 2K

- Replies

- 38

- Views

- 529

ADVERTISEMENT

ADVERTISEMENT