This decision by Pittman is wrong.... and has a long way as you say to go...

https://www.cnn.com/2022/11/12/opinions/student-loan-relief-program-judge-vladeck/index.html

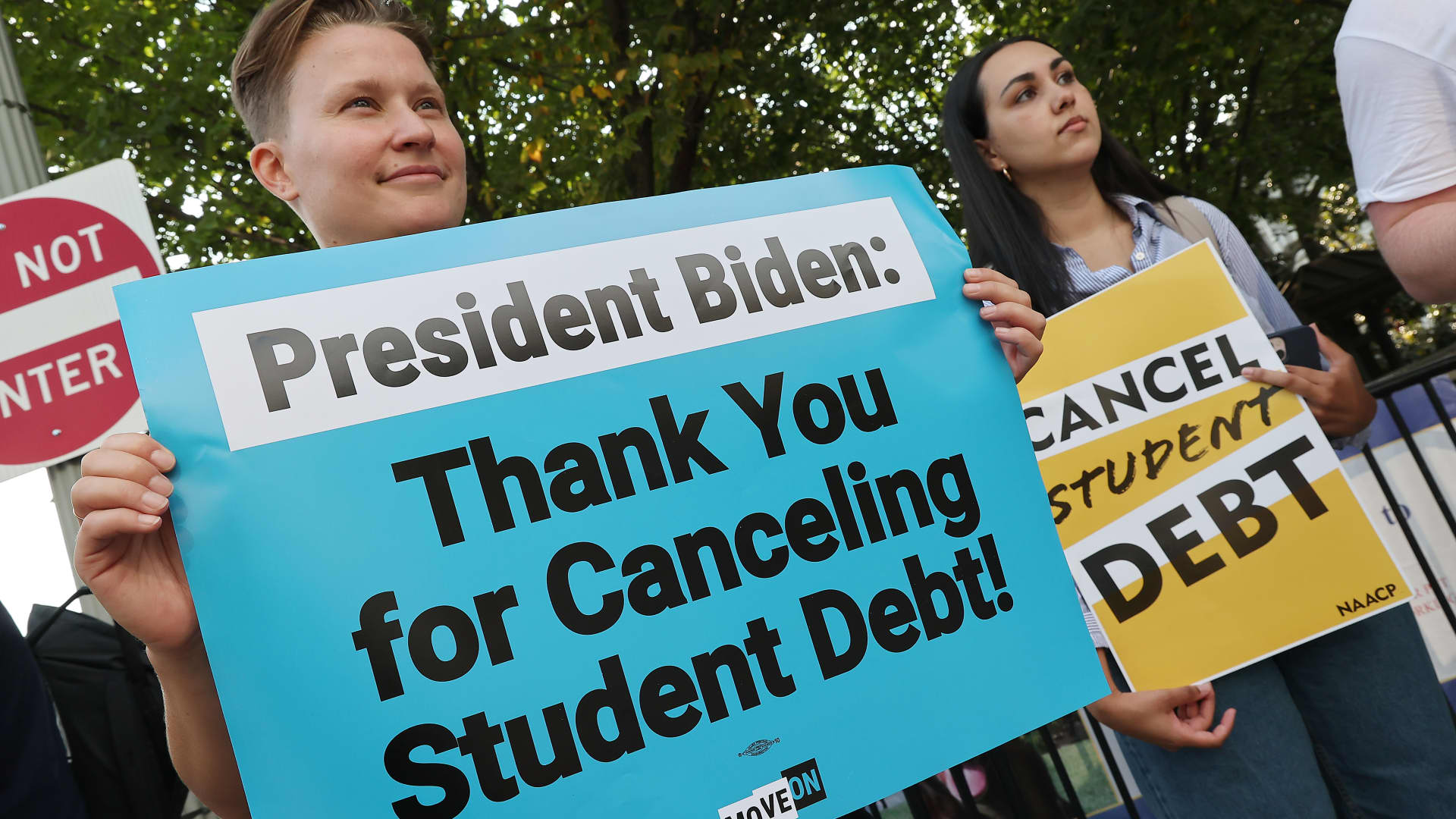

Opinion: The judge blocking student loan relief for millions is wrong about the law

by Steve Vladeck

Updated 4:15 PM EST, Sat November 12, 2022

But the biggest problem with Pittman’s ruling isn’t its substance; it’s why he allowed the case to be brought in the first place.

Every other challenge to the Biden program that’s been brought thus far (and there have been a bunch) have been thrown out by

trial courts for lack of standing – the term courts use as a shorthand for whether the dispute before them is the kind of controversy over which the Constitution allows them to exercise judicial power.

In a nutshell, a case’s standing has three elements: That the plaintiff shows an “injury in fact”; that the injury is “fairly traceable” to the defendant’s allegedly wrongful conduct; and that the courts are able to provide at least some redress for their injuries.

If the complaint is just that the government is acting unlawfully in a way that doesn’t affect plaintiffs personally, that’s a matter to be resolved through the political process – not a judicial one. As Justice Antonin Scalia

put it 30 years ago, “vindicating the

public interest (including the public interest in Government observance of the Constitution and laws) is the function of Congress and the Chief Executive.”

That’s why, until Thursday, each court to rule on a lawsuit challenging the Biden student loan debt relief program had dismissed the suit for lack of standing, like

the St. Louis-based federal district court in a suit brought by six red states. Whether the plaintiffs were taxpayers or states, the problem was the same: Like it or hate it, when the government hands out a benefit to a class of individuals, that doesn’t

usually injure other individuals discretely.

Instead, objections to the Biden program present the classic kind of “generalized grievance” that the Supreme Court has long held federal courts lack the constitutional authority to resolve – like when a taxpayer

tried to sue the CIA in an attempt to force the agency to provide a public accounting of its (allegedly unlawful) expenditures.

Against that backdrop, Judge Pittman’s holding that the two plaintiffs in his case had standing just doesn’t hold up. For both of them – Myra Brown and Alexander Taylor – Pittman tied their standing to the fact that

they are partly or fully ineligible for the program. The injury they suffered, in Pittman’s view, is that they were unable to argue for more expansive eligibility criteria that would’ve included them – not that the program itself is unlawful. That reasoning, such as it is, is especially ironic for two reasons.

www.foxbusiness.com

www.foxbusiness.com