https://www.yahoo.com/news/bidens-administration-just-filed-full-142315165.html

Biden's administration just filed a full legal defense of its student-loan-forgiveness plan to the Supreme Court, saying the debt relief falls 'comfortably' within the law

Ayelet Sheffey

Thu, January 5, 2023 at 9:23 AM EST

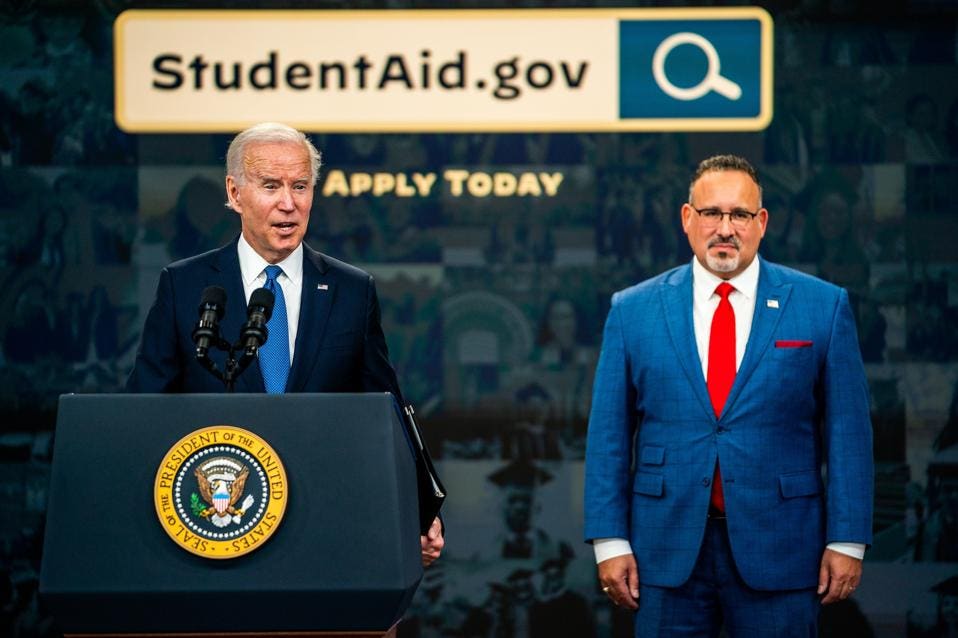

The Biden administration Wednesday night filed its full legal defense of its student-loan forgiveness ahead of the case landing at the nation's highest court next month.

The Justice Department filed a brief to the Supreme Court defending Biden's plan to cancel $20,000 in student debt for Pell Grant recipients making under $125,000 a year and $10,000 for other federal borrowers under the same income cap.

This filing comes ahead of February 28, when the Supreme Court is set to hear oral arguments on the two lawsuits that have blocked the implementation of the debt relief. One lawsuit, filed by six Republican-led states, argued the relief would hurt their states' tax revenues and that of student-loan company MOHELA. The other lawsuit was filed by two student-loan borrowers who sued because they did not qualify for the full $20,000 amount of relief.

Biden's administration has consistently argued that those lawsuits don't have merit and expressed confidence in the authority it used to cancel student debt under the HEROES Act of 2003, which gives the Education Secretary the ability to waive or modify student-loan balances in connection with a national emergency, like COVID-19. The Justice Department emphasized the relief's legality and how it falls "comfortably" within the law, and its efforts to ensure borrowers do not leave the pandemic worse off than when they started.

Biden's administration just filed a full legal defense of its student-loan-forgiveness plan to the Supreme Court, saying the debt relief falls 'comfortably' within the law

Ayelet Sheffey

Thu, January 5, 2023 at 9:23 AM EST

- The Justice Department Wednesday filed a defense to SCOTUS of Biden's student-debt relief.

- The Supreme Court will hear oral arguments in the case on February 28.

- The department remained confident in the legality of enacting broad loan forgiveness.

The Biden administration Wednesday night filed its full legal defense of its student-loan forgiveness ahead of the case landing at the nation's highest court next month.

The Justice Department filed a brief to the Supreme Court defending Biden's plan to cancel $20,000 in student debt for Pell Grant recipients making under $125,000 a year and $10,000 for other federal borrowers under the same income cap.

This filing comes ahead of February 28, when the Supreme Court is set to hear oral arguments on the two lawsuits that have blocked the implementation of the debt relief. One lawsuit, filed by six Republican-led states, argued the relief would hurt their states' tax revenues and that of student-loan company MOHELA. The other lawsuit was filed by two student-loan borrowers who sued because they did not qualify for the full $20,000 amount of relief.

Biden's administration has consistently argued that those lawsuits don't have merit and expressed confidence in the authority it used to cancel student debt under the HEROES Act of 2003, which gives the Education Secretary the ability to waive or modify student-loan balances in connection with a national emergency, like COVID-19. The Justice Department emphasized the relief's legality and how it falls "comfortably" within the law, and its efforts to ensure borrowers do not leave the pandemic worse off than when they started.