It never has been...

But that's not the only thing you have wrong about the IRS & the funding

https://www.marketwatch.com/story/y...adly-force-but-heres-some-context-11660247355

Yes, the IRS is hiring criminal investigators empowered to use deadly force — but here’s some important context

Last Updated: Aug. 15, 2022 at 3:09 p.m. ET

The Internal Revenue Service’s operations are catching heat as the tax agency is in line for an $80 billion budget boost under the Democrats’ proposed spending plan — and now there’s intense attention being focused on IRS workers who actually pack heat.

It started as criticism from Republican leaders that the tax-collecting agency would bring on 87,000 new employees to “target regular, everyday Americans” with the $80 billion earmarked for the IRS in the Inflation Reduction Act reconciliation bill, which looks poised to become law. That’s a “

misleading” claim, according to the Associated Press.

The bill passed Friday in a

220-207 vote of the House of Representatives and is now headed to President Joe Biden’s desk to be signed into law.

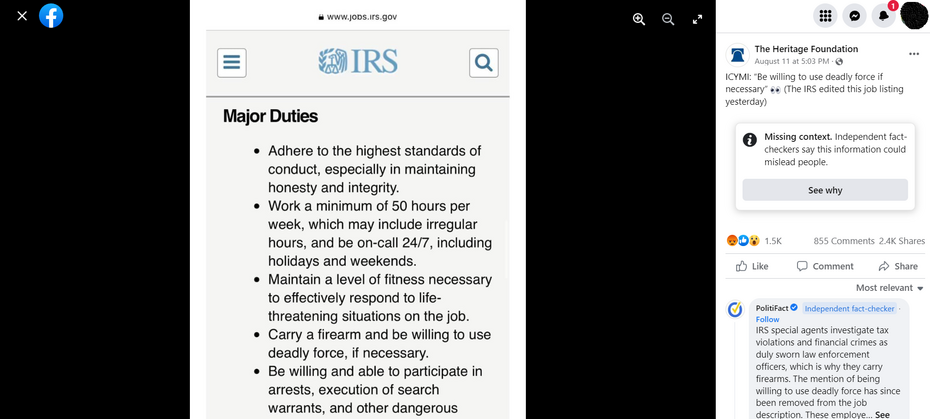

In recent days there’s been an online stir over job postings for IRS special agents who carry guns as part of their work with the IRS’s Criminal Investigation Division.

Though the job is really about sniffing out income and accounting irregularities to build legal cases, one of the potential duties is “conduct[ing] or participat[ing] in surveillance, armed escorts, dignitary protection, undercover operations, execution of search and arrest warrants, seizures, etc.,” the

job listing states.

There are 300 vacancies for that role, which pays between $50,704 and $89,636 annually, according to the listing.

Though the job listing drew new attention this week, requiring some IRS special agents to potentially use deadly force is nothing new, an IRS criminal-investigation spokeswoman confirmed.

“The job description is consistent with previous special-agent announcements for the same position and consistent with announcements from other federal law-enforcement agencies,” the spokeswoman said, noting that the Criminal Investigation Division at the IRS is on its own the federal government’s sixth largest law-enforcement agency.

Following is some context on the special-agent listing and the broader debate over more funding for the IRS.

As a starting point, the estimate of the IRS’s bringing on 87,000 new employees came in 2021 from the Treasury Department, the AP noted. It would be a multiyear hiring plan and would encompass extra auditors plus an array of other jobs amid retirement and other IRS attrition, the AP added.

IRS ranks have been shrinking over the years. The IRS’s

annual data book shows that in the last fiscal year it had almost 79,000 full-time workers, nearly a 13% decrease from fiscal 2012.

Data show the criminal division is a sliver of the IRS’s overall workforce. The division includes approximately 3,000 employees, with 2,100 being sworn agents, the spokeswoman noted.

As the agency’s workforce has decreased, so has the IRS’s audit rate among taxpayers at all income levels. Government data shows the decrease is

especially sharp for higher earners.

More than half of the $80 billion in supplemental funding in the Inflation Reduction Act would be earmarked for more tax-compliance enforcement. Officials, including Treasury Secretary

Janet Yellen and IRS Commissioner

Charles Rettig, a Trump pick to lead the agency in 2018, have pledged that the extra enforcement would not be directed at small businesses or households making less than $400,000.

“Contrary to the misinformation from opponents of this legislation, small business or households earning $400,000 per year or less will not see an increase in the chances that they are audited,” Yellen said.

Three-quarters of voters say they are not personally worried about being audited by a better-funded IRS, according to a

Morning Consult/Politico poll Wednesday. More than half, 56%, said they were not worried about more audits generally.

The Inflation Reduction Act now awaits Biden’s signature, and the Democratic president has previously said would sign the bill. From that point, a fuller anticipation to lawmakers would be expected from the IRS later, tax experts said — and some worry there are

still too few resources being devoted to helping regular taxpayers with questions.

The $80 billion — again, that’s spread over a decade — would be on top of annual budget appropriations for the agency. The debate over the funding is heated, with some observers saying the IRS needs every cent and others saying it needs no extra money.

For instance, Mark Everson, who served as IRS commissioner during the George W. Bush administration from 2003 to 2007, said the agency needs more money,

but not at this magnitude. Extra, inflation-adjusted appropriations around 3% to 5% are a better bet for manageable growth, said Everson, vice chairman of alliantgroup, a specialty tax-services provider.

“The IRS needs to proceed extremely carefully as it ramps up,” he said, adding that “they’ve got to get the right people.” That holds true within the criminal division, he said.

The division itself is “a relatively small part of the agency, but it’s very important, both in terms of the role it plays for criminal tax problems and in support of other violations of law, including terrorism and corporate fraud.”

Criminal Investigation Division officials have to be involved in law-enforcement efforts because “financial information is frequently an important element of federal criminal investigations,” Everson said. “They play an essential role.”

The scandals and criminal cases surrounding WorldCom and Enron were two instances in which the division played an instrumental role, Everson said. More recently, the division was involved in the 2013 takedown of the

Silk Road underground website on which sales of drugs and illegal services were powered by the emergence of bitcoin

BTCUSD, -2.22% as a payment means.

During fiscal 2021, the IRS completed almost 2,800 criminal investigations, with most resulting in referrals to prosecution. That included more than 1,000 cases related to tax crimes, like evasion; 979 financial-crime cases including money laundering; and 735 drug-related financial crimes.

The long view shows the drain on the Criminal Investigation Division, as well. In the 2011 fiscal year, the division completed nearly 4,700 investigations,

according to IRS data.