Housing Crash Imminent: As Mortgage Rates Explode Price Cuts Soar And Buyer Demand Collapses | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

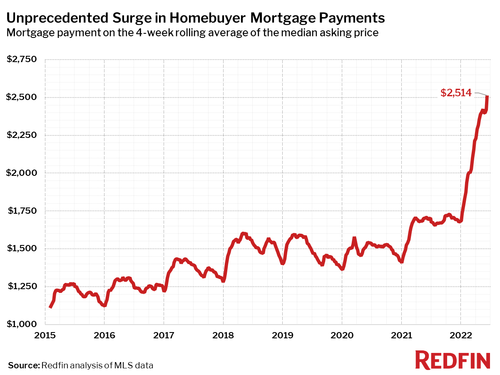

The first shows that after the period of unprecedented gains for home prices and a uniformlly sellers market, has flipped, and according to Redfin, the highest share of sellers on record dropped their list price during the four weeks ending June 12 as mortgage rates shot up to levels not seen since 2008, collapsing the pool of potential home shoppers.

A key metric to watch is the contract cancellation rate, said Rick Palacios, research director at John Burns Real Estate Consulting in Irvine, California. It topped 9% nationally in May, according to his company’s survey of builders, up from 6.6% in April. That’s still short of the 16% pace after the pandemic lockdowns first took hold two years ago.

“The writing is on the wall that more supply is coming, no matter how you slice and dice the data,” Palacios said. “Builders are trying to get in front of that wave. We could have the double-whammy of the economy cooling and a lot of supply coming on. That’s not the best recipe to sell homes.”

----------------------------------------------------------

Well we already know Brandon is crashing the stock markets and even cryptos as all the markets quickly dropped into a bear market. Now housing is set to implode by the end of the year if my guess is correct along with the markets collapsing a lot more.

Talking to some construction people here in Florida the builders have just about stopped all their land purchases except for a very few deals closing right now and they are walking away from deals they made for land a few months back as Florida lets them use any made up excuse to do that as long as the deal hasn't made it to closing. One excuse they are using for former groveland to walk away is that it will take more dirt than they thought even though the former grove is no different than all the other ones they bought these past years. Also you now have buyers starting to walk away prior to closing thinking we will have a big drop in prices like happened in 07/08. This is going to get real bad before it gets better.